BorgWarner: A Stock Worth Buying Amidst The Automotive Transition (NYSE:BWA)

DNY59/E+ via Getty Images

BorgWarner Inc. (NYSE:BWA) is a stock that investors could potentially consider for inclusion in their portfolios. The stock has a unique position in the market, and I believe it will maintain its impressive growth trend, despite a wider industry-wide slowdown. Given its growth prospects in the dynamic and sustainable electric vehicle sector, BWA stock is a buy.

Company Overview

BorgWarner Inc. is a large company that specializes in automobile engine components and systems, whilst catering to combustion, hybrid, and electric vehicle markets. Employing over 50,000 individuals worldwide, and with a presence in 22 different countries, BorgWarner is in the top 25 automotive suppliers in the world, making it a giant in this mammoth global industry. In terms of the vehicle markets the company serves, BorgWarner caters to Light Vehicles, Commercial Vehicles, Off-Highway and Aftermarket Vehicle markets.

In the recent shift seen in the last decade towards eMobility, BorgWarner has been a primary market player that, through its vision of sustainability, has helped facilitate the market towards higher energy efficiency standards. As of 2022, BorgWarner Inc has won, for the third consecutive year, the Newsweek Award mention for ‘America’s Most Responsible Companies of the Year’, on the basis of a range of sustainability-related key performance indicators.

The Auto Parts Industry, Inflation, And BorgWarner

Typically, when macroeconomic conditions take a dip, one of the most impacted industries is the automotive industry, with dealerships facing inventory shortages, supply chain obstructions, and production-related disruptions. This is especially true during times of inflation, where price uncertainty leads to panic throughout the industry, which is exacerbated by dropping demands that come with reduced disposable incomes.

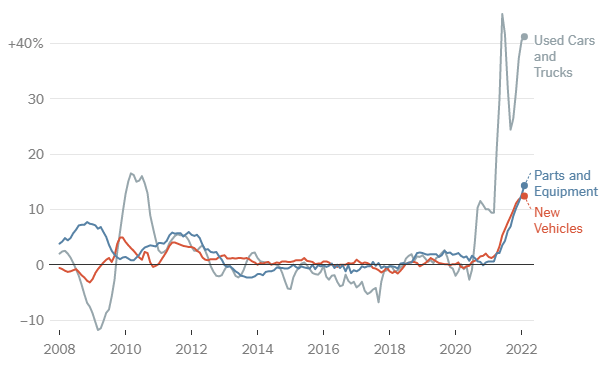

The most direct indicator of the adverse impact of inflation on the automotive industry is the rise in prices of new and used cars, as well as car parts. The trends show rapid car inflation after 2020, in select automotive categories of the Consumer Price Index.

Bureau of Labor Statistics

Given the market pressures, and increasing levels of inflation impacting the market, the most substantial surge had been recorded in the prices of used cars and trucks. This is because disruption in the supply of new vehicles has led to a rush in the used car market, which has driven up prices, especially during the early months of 2020, when the coronavirus pandemic first erupted. Similarly, new car prices saw a substantial rise. A major reason for this uptrend is the combined effect of increased prices in the market and higher interest rates, which makes car loans far more costly for buyers. As a result, demand, especially for new cars plummets, adversely impacting the broader profitability prospects of the industry.

In the case of companies such as BorgWarner, which supply engine-related systems and solutions, there is a higher degree of complexity involved, especially given the elasticity of its demand. The engine and components market is one that is resilient and sustainable, according to commentators who attended the Global Summit hosted by the Automotive Aftermarket Suppliers Association and the Overseas Automotive Council, in March 2022. However, a number of critics at the event opposed this viewpoint, arguing that despite the elasticity of engine components, an increase in running costs and delays from critical suppliers are likely to chip away at earnings by significant levels.

To add a further layer of complexity to this discussion, BorgWarner Inc, also has to account for the increase in demand for hybrid and electric vehicles, and subsequently engine parts. As a result of this surging demand, the company is likely to see upward momentum, especially as rising oil costs continue to push individuals towards more sustainable and cost-efficient options. However, there is further anticipation of an increase in the use of public transport services during times of high inflation, which could prove adverse for BWA prospects. It is likely that the impact of a shift to public transport would be short-term, as the purchase of cost-efficient electric or hybrid vehicles is a far more sustainable move. Whether or not BWA proves a good choice amidst this potential opportunity is to be determined by its financial performance.

Financial Assessment

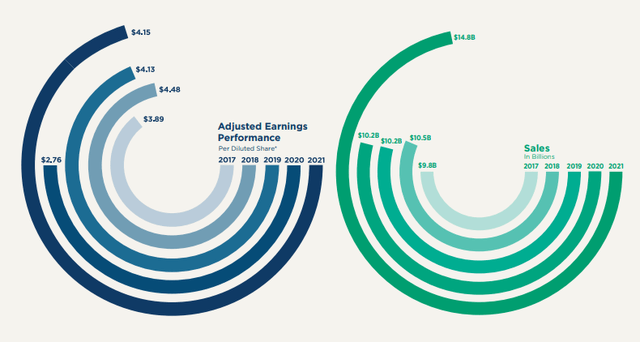

In BorgWarner’s most recent annual earnings report for FY21, the company delivered record sales of $14.8 billion, which was substantially higher than its revenue figures dating back to 2017. Similarly, the company’s adjusted earnings per share of $4.15 per share came at a significant jump of over 50%, indicating a strong recovery from the disruptions brought about as a result of the Covid-19 outbreak in 2020. The extent of this growth is better visualized in the representations mapped out below:

BWA Annual Report FY21

In comparison to the broader automotive industry, which saw a 2% revenue growth throughout 2021, the organic 12% growth spurt delivered by BWA is exceptional for its shareholders.

Similarly, the liquidity position of the company had increased substantially throughout the year, with its cash equivalents standing at $1.84 billion against the 2020 figure of $1.65 billion. However, the year also brought on a climb in the company’s total debt from $3.7 billion in 2020 to $4.2 billion in 2021. This financing, which will be used to fund further growth for the company could be critical for its ventures undertaken in the future.

Similarly, the company had undertaken major acquisitions throughout the year which had included 100% of Delphi Technologies PLC (DLPH) in order to strengthen and scale up its hold on electronic products. Moreover, the German EV battery manufacturer, AKASOL AG (OTCPK:AKSLF) was acquired by the purchase of 89% of its ordinary outstanding shares. The moves are a clear indication of the company’s growth prospects, which could prove useful in the upcoming inflationary period. These long-term investments are such that the value translation would result in several years later, as opposed to immediate growth spurts in EPS.

Valuation

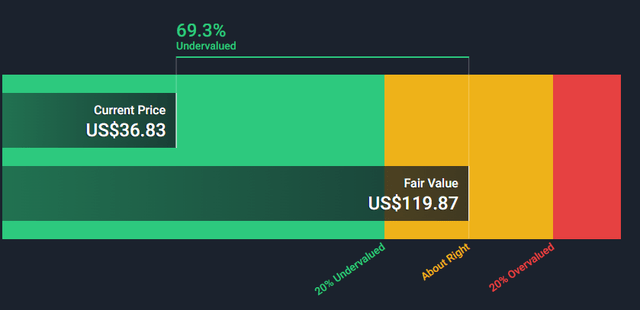

On the basis of a number of metrics, I believe BWA stands largely undervalued, especially given the investment potential it holds during the current inflationary macroeconomic conditions faced by the market. Firstly, the stock stands as being heavily undervalued, in comparison to its fair value. This undervaluation is almost at 70%, which indicates why this stock is such a strong buy.

Simply Wall St

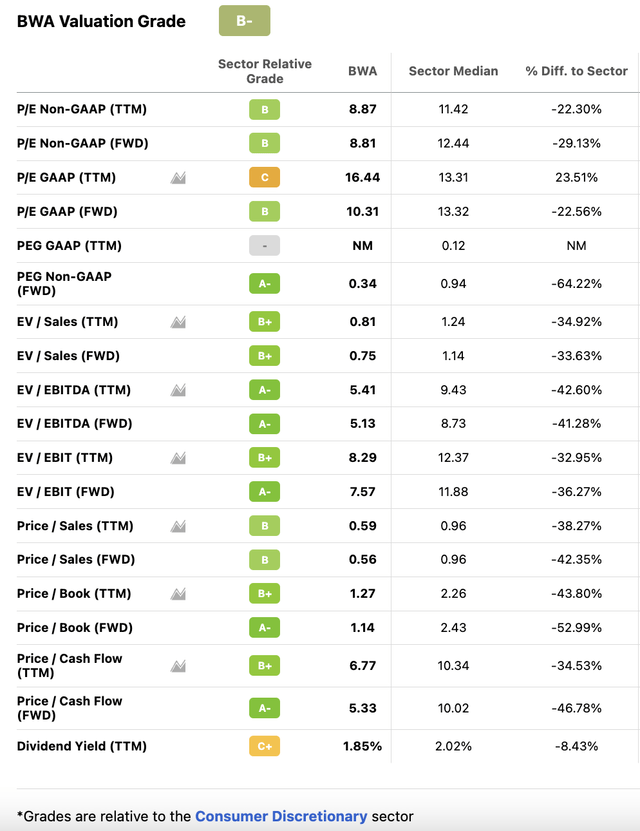

Similarly, the stock’s PE ratio of 8.87 as of May 2022 is below the sector median of 11.42. This significant gap indicates that earnings from BWA come at a higher yield for investors, making it a potentially efficient investment. It further reinforces that view of the stock being undervalued in comparison to the broader market.

BWA Valuation Grade (Seeking Alpha Premium)

Additionally, its low PEG ratio of 0.34 and P/S ratio of 0.59 further indicate its undervaluation, which investors will eventually capitalize on, as a result of which the stock’s price will be driven up, and BWA would achieve stability. Its Price to Book ratio of 1.27 is also below the sector median of 2.6, highlighting that the stock is currently trading at a substantial discount.

Risks

The most significant risk that pertains to the BWA sustainability, which is especially relevant to investors considering long positions in the stock during the wider macroeconomic disruptions impacting the global markets, is the pressure it faces from original automotive manufacturers [OAMs] to drive down costs. OEM customers that anticipate an improvement in EV engines, in terms of efficiency and cost, demand annual product price reductions, which could prove unsustainable for BorgWarner Inc. The company’s business strategy to ensure these price reductions is to reduce its supply-side costs, whilst further attempting to bring down operational inefficiencies within its production processes.

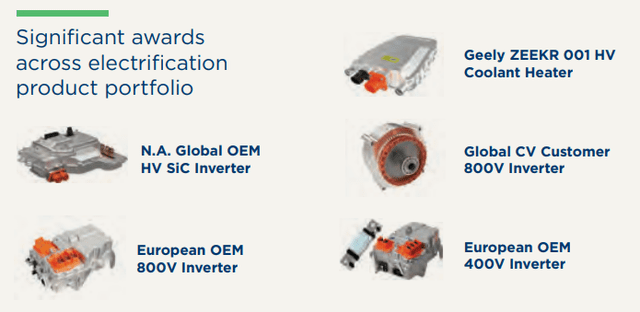

As the broader macroeconomic conditions worsen, combating this challenge would become increasingly difficult, and a major share of the cost burden would need to be inevitably handed over to the customers. Securing contracts for lower-cost raw materials is also a viable option, however, it holds the risk of impacting the quality of BorgWarner products, which could prove devastating for the company’s long-term market growth prospects. In order to override this threat, the company would need to shift its strategic focus toward research and development which could continue its trend of low-cost and high-efficiency products. Some of these launched products from 2021 are highlighted below:

BWA FY21 Annual Report

Conclusion

The automotive industry is currently undergoing a decline phase, given a wide range of macroeconomic and market shifts. However, BWA is a stock that is strategically positioned to rise above others, despite these challenges, standing ready to capitalize on these dynamic shifts.

I believe BWA is a good stock to buy during this period, when the industry is undergoing a transition towards a more sustainable form, given its impressive financial performance, as well as due to the sheer degree of its undervaluation. It is unlikely for the company’s growth to be adversely affected given the pressure amongst consumers to shift to electric and hybrid vehicle options. For those looking to park their savings in a high-growth stock, BWA is your go-to stock.