Leading Indicators in Heavy-Duty Truck Market Signal Weakening Asking Values

LINCOLN, Neb., May 11, 2022 /PRNewswire/ — Noteworthy shifts in equipment market trends indicate it’s a good time for dealers, fleet owners, operators, and rental companies to assess the values at risk with their machines. Such a shift is currently occurring in the heavy-duty truck market as outlined in the latest Sandhills Global Market Reports. Since the beginning of 2022, heavy-duty truck auction values have displayed a 7-percentage-point decrease while inventory levels have increased 28 percentage points. These trends are significant because decreasing auction values and increasing inventory levels have historically been leading indicators of downward asking values.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. In this month’s report, you’ll see the changing value and inventory trends with a historic perspective of how asking values for heavy-duty trucks have decreased after leading indicator swings similar to current market trends.

ng a 33.2% YOY decrease in March to a 29% YOY decrease in April.

U.S. Used Heavy-Duty Trucks

-

Auction value trends have been a leading indicator of changing asking values in the ensuing months. This April, asking values for heavy-duty trucks maintained an upward trend, increasing 59.2% year-over-year; sellers should monitor these values closely moving forward.

-

In April, the Sandhills EVI charted a 57.3% YOY auction value increase; by comparison, auction values this January were up 64.3% YOY, showcasing the downward value trend since the beginning of the year.

-

Asking values have historically declined when there is a significant increase in inventory levels. Although heavy-duty truck inventory levels were down 30% YOY in April, this marks a 12.7-pecentage-point increase from March 2022 when inventory levels were down 42.7% YOY.

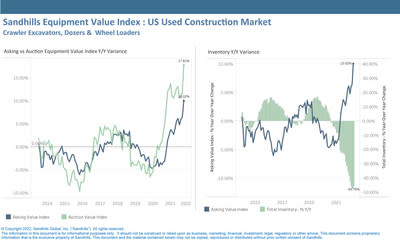

U.S. Used Construction Equipment

-

Used construction equipment values continued an upward trend in April. Auction values were up 17.8% YOY and asking values were up 10% YOY.

-

Inventory levels within the construction market, which includes dozers, crawler excavators, and wheel loaders, were down 45.8% YOY in April. This is a slight increase from March, when inventory levels were down 47.7% YOY.

U.S. Used Farm Equipment

-

Auction values for used farm equipment displayed a 10.5% YOY increase in April. Asking values were fairly flat, increasing just 6.4% YOY.

-

The Sandhills EVI found inventory levels for farm equipment increased slightly from March to April, moving a 33.2% YOY decrease in March to a 29% YOY decrease in April

.Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About Sandhills Global

Sandhills Global is an information processing company headquartered in Lincoln, Nebraska. Our products and services gather, process, and distribute information in the form of trade publications, websites, and online services that connect buyers and sellers across the construction, agriculture, forestry, oil and gas, heavy equipment, commercial trucking, and aviation industries. Our integrated, industry-specific approach to hosted technologies and services offers solutions that help businesses large and small operate efficiently and grow securely, cost-effectively, and successfully. Sandhills Global—we are the cloud.

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.

Contact Sandhills

www.sandhills.com/contact-us

402-479-2181

View original content to download multimedia:https://www.prnewswire.com/news-releases/leading-indicators-in-heavy-duty-truck-market-signal-weakening-asking-values-301545108.html

SOURCE Sandhills Global