Medical Properties: Loading Up The Truck; Attractive Yield (NYSE:MPW)

ipopba

Clinical Qualities Have faith in Inc. (NYSE:MPW) is now very appealing to investors on the lookout to build a passive income-oriented portfolio comprised mainly of nicely-managed and growing REIT trusts.

In my view, Clinical Attributes is a fantastic investment, based mostly on price, dividend expansion potential, and yield, especially in a marketplace plagued by recession fears.

A Leading Well being Care Belief With A 7.4% Yield

Clinical Attributes is a health and fitness treatment REIT centered in the United States, while it also has hospital investments during Europe. The trust’s principal investment decision focus is on hospitals that provide patients with acute cure and rehabilitation providers.

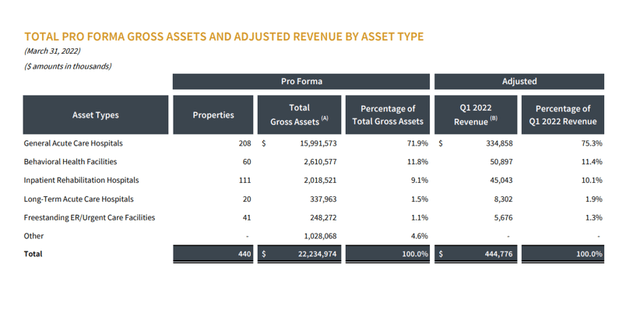

The bulk of the trust’s recurring income occur from basic acute care hospitals, which account for 71.9% of gross property (just before amassed depreciation) and 75.3% of revenues.

Other facilities and hospitals are also significant for Medial Qualities, albeit to a far decrease extent than typical acute treatment hospitals, exactly where the believe in provides the most dollars. Medical Qualities experienced two a lot more properties in its portfolio, totaling 440, in contrast to the prior quarter.

Modified Profits By Asset Form (Clinical Attributes Belief)

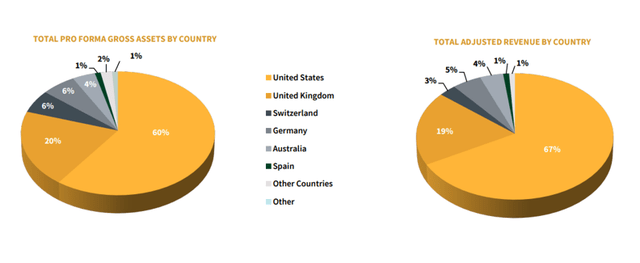

The trust’s serious estate assets are focused in only two markets: the United States and the United Kingdom. The two marketplaces account for 86% of Professional medical Properties’ profits.

Target On Two Nations around the world (Medical Attributes Rely on)

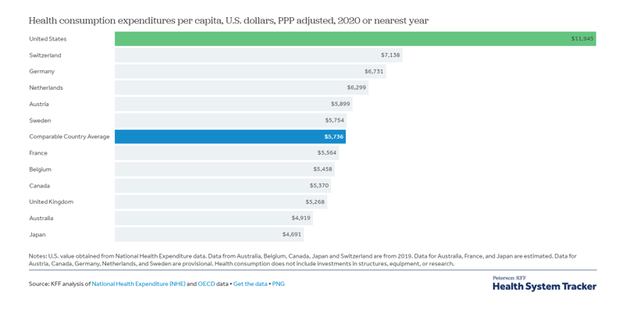

Because of to large for each capita wellbeing investing, the United States is the most worthwhile current market for wellbeing treatment trusts. No other nation spends as substantially money on health and fitness care as the United States does.

In 2020, for every capita well being expenses in the United States were about $12K, practically 67% increased than the second optimum spender on a for each capita foundation: Switzerland.

Wellness Usage Expenditure Per Capita (healthsystemtracker.org)

Since Health care Properties’ principal business is investing in clinic and acute treatment amenities, the belief is mostly immune to the possibly disastrous impacts of a economic downturn.

Well being treatment paying out is not discretionary, implying a somewhat consistent demand pattern and providing Health care Homes with a higher diploma of predictability in conditions of money flows and dividend growth.

Prospective For Dividend Expansion And Payout Ratio Are Instantly Linked

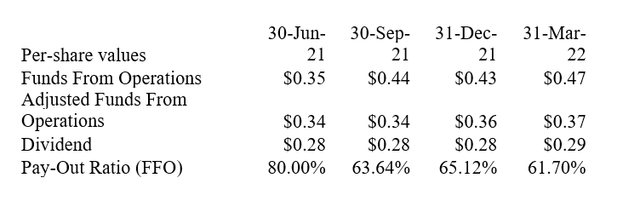

In basic, actual estate investment decision trusts with lower payout ratios based on funds from operations are the most secure REITs in the current market.

Low payout ratios, described as 60-70% of FFO, mean that trusts may well find the money for to increase dividends even if economic issues arise.

Provided that Clinical Properties has a payout ratio of 67% above the past twelve months, MPW is a stock that could supply sturdy dividend raises in the potential.

Payout Ratio And Dividend (Writer Produced Table Making use of Believe in Financials)

Health care Qualities intends to maximize its quarterly dividend by $.01 for each share just about every 12 months, so assuming this pattern continues, dividend buyers will get an yearly payout of $1.20 upcoming year, or a 7.6% return.

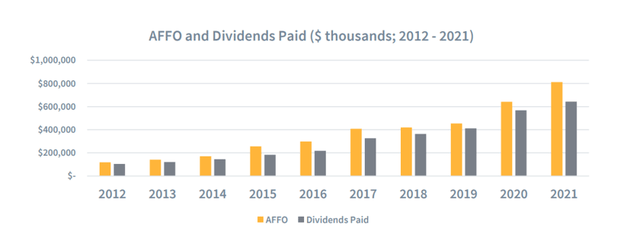

MPW presently has a stock generate of 7.4%. Dividends and altered cash from operations have greater around time in the have confidence in.

AFFO And Dividends Compensated (Clinical Attributes Belief)

Low-priced FFO A number of

Medical Houses has a respectable valuation. The valuation various I make use of for health treatment REITs, or trusts in normal, is centered on cash from operations, which is an essential statistic employed to review authentic estate expense trusts.

According to Medical Properties’ forecast for 2022, the believe in expects to make $1.78-1.82 for every share, implying an FFO many of 8.7x, the most affordable in years. Clinical Attributes is hard to resist in terms of the two valuation and yield.

Why Professional medical Attributes Could See A Lessen FFO Multiple

If the economy enters a slump, Clinical Properties’ FFO numerous could fall much even further. However, the recent macro photo is inconclusive.

While inflation is a warning signal for the economy, the most the latest labor market place report did not suggest a economic downturn. Nonfarm payrolls rose by 372K in June, exhibiting that the task market is not however in a slump. Having said that, if the U.S. overall economy were being to enter a economic downturn, we would very likely see decreased valuation multiples in the overall health treatment REIT marketplace.

In terms of precise REIT challenges, a decrease in critical general performance steps these kinds of as occupancy premiums or income circulation could guide to greater complications for the REIT in the long term. For the reason that health care paying out is rather recession-resistant, I believe these hazards are unwarranted.

My Summary

I am now getting as significantly MPW as I can and would invest in even more of the trust’s inventory if I had the liquidity to do so.

The most desirable facet of Clinical Attributes, in my view, is that the trust’s main business is recession resistant. The level of desire, inflation, or GDP progress premiums have very little bearing on or affect on wellness treatment paying out.

Mainly because Health care Properties has a very low payout ratio (67% primarily based on FFO) and a reduced FFO multiple, the health care belief signifies very good price for dividend buyers.